I read this post on LinkedIn by Andreas Tsanakas that referenced a paper by Ole Peters titled Insurance as an Ergodicity Problem.

It seems intuitive that an equal chance bet that would allow you to win 50% or lose 40% of the value of the bet would have a positive expected value, but in the long run such a bet will bankrupt you if you bet it all each time.

This motivates the idea that financial transactions are a solution to an ergodicity problem. A transaction in financial markets (buy insurance, etc) provides long-term value retention and growth without needing to appeal to economic concepts of concavity of utility functions and risk-aversion.

It also explains how saving part of your income in each time period and investing only a fraction of your wealth in any gamble makes sense (a type of self-insurance) when the outcomes have multiplicative and not additive impacts on your life as it surely does in the real world.

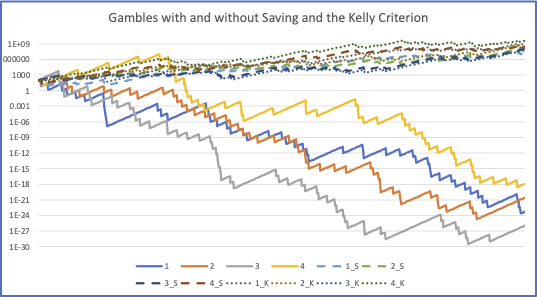

I made a spreadsheet to illustrate the main points in the paper Ergodicity Spreadsheet Model which plots four random multiplicative series and 4 of the same with savings and withdrawals that would be similar to paying a premium in good years and getting an indemnity in poor years.

I also tested the Kelly Criterion which might be the optimal solution (betting an optimal proportion of the wealth in each time period). The model could be made more realistic but I think it illustrates the point that using expected values (arithmetic average) leads to the wrong conclusions in some cases where there are multiplicative impacts in a dynamic system and that some forms of exchanges is motivated by individual’s long-term thinking where expected values over groups may not be a good model for how people behave.

Some other relevant posts on the subject:

https://behaviouralinvestment.com/2020/05/13/we-need-to-talk-about-ergodicity/